Elsewhere in this newsletter we have looked at some of the huge penalties that have been levied by HMRC. The amount of penalties charged have increased recently under certain circumstances. Below we look at how penalties are calculated, and when they have now been increased.

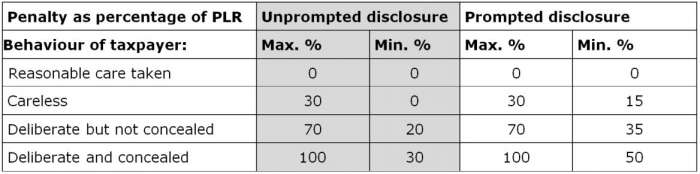

When a taxpayer fails to notify HMRC of their tax liability or makes an error (careless or deliberate) in a tax return, HMRC can charge the taxpayer a penalty, calculated as a percentage of the “potential lost revenue” (PLR). There are statutory bands of percentages set for each type of taxpayer behaviour, and which vary according to whether the error was disclosed voluntarily with no prompting by HMRC or disclosed after an HMRC prompt, as follows:

Within each band where the final penalty sits depends on the “quality” of the disclosure. “Quality” has three elements: telling (30%), helping (40%), and giving access (30%). The amounts in brackets are the percentage by which the maximum possible penalty is reduced within the statutory range. Each of those elements is judged by HMRC according to its timing, extent and nature.

Timing is important

Timing is a key part of determining the quality of the disclosure. HMRC views an error reported within 12 months of its occurrence or 12 months of the date notification should have been made, as being a higher quality of disclosure than when the same error is reported a significant period after it occurred. This 12-month period is built into the penalties for failure to notify, with lower penalties charged if the notification is made within 12 months of when it should have been made.

HMRC changed its practice in relation to penalties for disclosures made from September 2017, and they now state that “If you’ve taken a significant period (normally 3 years) to correct or disclose the inaccuracy we’ll normally restrict the amount of reduction given for disclosure. We’ll restrict the penalty range by 10 percentage points above the minimum to reflect the time taken before working out the reductions for telling, helping and giving.”

Significant period

The HMRC guidance implies that if the error is reported within three years, the maximum mitigation of the penalty is possible. However, the penalty percentages are increased by ten percentage points where errors or failure to notify are disclosed after more than three years. A careless error reported after three years with no prompting will now carry a minimum penalty of 10% of PLR. A prompted disclosure of an error delayed for over three years carries a minimum penalty of 25%. It is not clear from the guidance what HMRC will count as the start of the three-year significant period. This could be: the date of the error occurred, or the end of the tax year or accounting period in which the error or failure occurred, or the date when the error was discovered.

This change in HMRC practice will affect taxpayers who want to make a voluntary disclosure of careless errors, or of mistakes made while they took due care. In the past, such individuals could make penalty-free disclosures to HMRC, which encouraged compliance and saved time and money as HMRC didn’t have to investigate the matter themselves. Now, where the taxpayer discovers an error or their accountant finds it for them, it will be important to make a disclosure to HMRC as soon as is practical. Any delay which takes the disclosure outside the three-year period (to be defined!) could cost the taxpayer a further 10% in penalties.